Table of Contents

Union Bank of India Wealth Manager Exam Date 2025 has been officially announced by the Bank under the Union Bank Specialist Officer recruitment drive. The bank has released a total of 250 vacancies for the Wealth Manager (MMGS-II) post. Applicants must now prepare to appear for the upcoming exam. Check the details below to know the exam schedule, salary, selection process, and other important information.

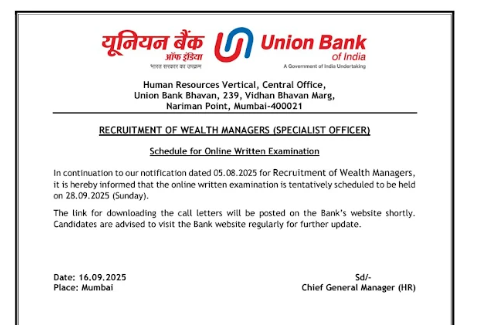

Union Bank of India Wealth Manager Exam Date 2025 Out

The Union Bank of India has released the schedule for the online written exam for the recruitment of Wealth Managers (Specialist Officer). As per the latest update, the exam is tentatively set for 28th September 2025 (Sunday). The call letters will be available soon on the Bank’s official website, and candidates are advised to visit regularly for further updates.

| Events | Dates |

| Notification | 4th August 2025 |

| Apply Online starts | 5th August 2025 |

| Last Date to Apply | 25th August 2025 |

| Union Bank SO Admit Card 2025 | 3rd week of September 2025 |

| UBI SO/Wealth Manager Exam Date 2025 | 28th September 2025 |

Union Bank Of India Wealth Manager Recruitment 2025- Highlights

Union Bank of India is conducting the Specialist Officer recruitment for the post of Wealth Manager to expand its staff base. The Wealth Manager will serve as the single point of contact for HNI clients, managing their banking, investment, and insurance needs. Check important highlights below:

| Particular | Details |

| Organization | Union Bank of India |

| Posts | Wealth Manager |

| Vacancies | 250 |

| Category | Bank Jobs |

| Online Registration Dates | Over |

| Application Mode | Online |

| Selection Process | Online exam, Group Discussion, and Interview |

| Official Website | @www.unionbankofindia.co.in. |

Union Bank SO Wealth Manager Recruitment 2025 Notification Out

Union Bank Wealth Manager recruitment drive is a great opportunity for experienced professionals looking to work in the banking sector at the Middle Management Grade Scale-II (MMGS-II) level. Candidates can check the complete eligibility, selection process, and other important details by downloading the Union Bank SO Notification 2025 PDF from the official website at unionbankofindia.co.in or through the direct link shared here.

Union Bank SO Recruitment 2025 Notification PDF

Union Bank Wealth Manager Vacancy 2025 Details

Union Bank of India has announced a total of 250 vacancies for the post of Wealth Manager under the Specialist Officer Recruitment 2025. These vacancies are distributed across various categories to ensure fair representation. Out of the total, 37 seats are reserved for SC, 18 for ST, 67 for OBC, 25 for EWS, and 103 for UR (General) category candidates.

| Category | Vacancy |

| Schedule Caste | 37 |

| Schedule Tribe | 18 |

| Other Backward Class | 67 |

| Economically Weaker Section | 25 |

| Unreserved category | 103 |

| Total Vacancies | 250 |

Eligibility Criteria for Union Bank Wealth Manager Recruitment 2025

The Union Bank SO Eligibility Criteria includes age limit and educational qualification. Check the details here.

Age Limit (As on 1/8/2025) For Wealth Manager Post

The age limit required for the Wealth Manager post is 25 to 35 years. Age relaxation is provided to reserved category candidates as shared below.

| SN | Category | Age Relaxation |

| 1 | Scheduled Caste (SC) / Scheduled Tribe (ST) | 5 years |

| 2 | Other Backward Classes (Non-creamy layer) | 3 years |

| 3 | Persons with Benchmark Disability (PwBD) | 10 years |

| 4 | Ex-Servicemen, including ECOs/SSCOs with at least 5 years military service and released due to completion, disability, or inefficiency | 5 years |

| 5 | Persons affected by 1984 riots | 5 years |

Wealth Manager Qualification Requirement

Candidates must have completed a full-time 2-year course in MBA, MMS, PGDBA, PGDBM, PGPM, or PGDM from a university or institution that is recognised by the Government of India or approved by a government regulatory body. The mentioned qualifications is for full-time 2-year programs only. Preferred Certifications (optional but beneficial):

- NISM

- IRDAI

- NCFM

- AMFI

Experience Required

Candidates must have at least 3 years of post-qualification experience in a managerial or officer-level role in Wealth Management. This experience should be with organisations such as public sector banks, private banks, foreign banks, broking firms, securities firms, or asset management companies.

Union Bank Wealth Manager 2025 Apply Online

The online application process for Union Bank SO Wealth Manager Recruitment 2025 has officially closed on the bank’s website, www.unionbankofindia.co.in. Before proceeding, applicants are advised to carefully go through the official notification to understand the eligibility criteria, required documents, and application fee details.

Union Bank SO Application Fee

The application fee for UBI SO Recruitment 2025 application form can be paid only online through a debit/credit card, internet banking, etc. Check the category-wise application fee amount below.

| Union Bank of India Recruitment 2025 Application Fee | |

| Category | Application Fee |

| UR/OBC | Rs. 177/- |

| SC/ST/PWBD | Rs. 1180/- |

Steps to Apply for UBI Wealth Manager Recruitment 2025

Step 1: Visit the Union Bank of India website: https://www.unionbankofindia.co.in/.

Step 2: On the homepage, go to the ‘Careers and Recruitment’ section.

Step 3: On the Career page, select ‘Click Here to Apply’ under the heading “Recruitment of Wealth Managers (Specialist Officers)”.

Step 4: A registration page will open. On the right side of the page, click ‘Click Here For New Registration’ and fill in your details like name, mobile number, and e-mail ID.

Step 5: A registration number and password will be sent to your registered mobile number or e-mail.

Step 6: Upload the necessary documents in the prescribed format.

Step 7: Click ‘Save’ after submitting the documents and proceed. Select the payment option and pay the application fee based on your category.

Step 8: Finally, click ‘Submit’ to complete the Union Bank of India SO Registration.

Union Bank of India Wealth Manager Selection Process 2025

The Union Bank has mentioned the detailed selection process in the official notification, and it includes 3 stages:

- Online Exam: 225 Marks Online exam

- Group Discussion: 50 Marks (Qualifying 24 marks and 22.5 marks for SC/ST/OBC)

- Interview: 50 Marks (Selection candidates will be called in the ratio of 1:3 against the vacancy).

UBI SO Wealth Manager Exam Pattern 2025

The first stage of the selection process is an Online exam which has two parts. Part 1 is 75 marks and Part 2 is 150 marks. All the questions are MCQ-based and total duration is 150 minutes. There is a negative marking of 1/4th or 25% for each wrong answer.

| Part | Name of the Tests | No. of Questions | Maximum Marks | Duration |

| Part I | Reasoning | 25 | 25 | 75 minutes |

| Quantitative Aptitude | 25 | 25 | ||

| English Language | 25 | 25 | ||

| Part II | Professional Knowledge (Relevant to Post) | 75 | 150 | 75 minutes |

| Total | 150 | 225 | 150 minutes |

Union Bank SO Syllabus 2025- Click to Check

Union Bank Wealth Manager Salary & Benefits

Vacancies are available for the Wealth Manager post in the MMGS-II grade with a basic pay scale of Rs. 64,820-23,40/1-67,160-2,680/10-93,960. The approximate CTC at the Mumbai centre is Rs. 21 lakhs per annum, which may vary by location and other factors.

When combined with allowances like Dearness Allowance (DA), House Rent Allowance (HRA), special allowances, and perks such as medical cover, travel reimbursement, leave fare concessions, and staff loans, the estimated in-hand salary can reach approximately Rs. 1.3 to Rs. 1.45 lakhs per month.

Union Bank Wealth Manager Job Profile & Responsibilities

Following are the duties and reponsibilities of a Wealth Manager at Union Bank of India:

- Act as the dedicated relationship manager for all banking requirements of High Net-Worth Individual (HNI) clients.

- Build, maintain, and enhance strong relationships with HNI clients to ensure long-term engagement.

- Promote and sell a wide range of investment and insurance products tailored to client needs.

- Focus on increasing the client’s overall relationship value and managing their investment portfolio to grow Assets Under Management (AUM).

- Carry out financial needs assessments and risk profiling for each HNI client to offer suitable financial solutions.

- Regularly review client portfolios to ensure alignment with financial goals.

- Ensure timely and accurate documentation of all client transactions and execute their instructions within the defined turnaround time (TAT).

- Organise training sessions or awareness programs for branches and field staff on insurance and investment products

SSC GD Exam Date 2026, New CBT Dates Out...

SSC GD Exam Date 2026, New CBT Dates Out...

PNB Apprentice Exam Date 2026, Expected ...

PNB Apprentice Exam Date 2026, Expected ...

Bank of Baroda Office Assistant/Peon Pre...

Bank of Baroda Office Assistant/Peon Pre...