Table of Contents

What are derivatives?

- A derivative is a contract between two parties, where the contract derives its value/price from an underlying asset.

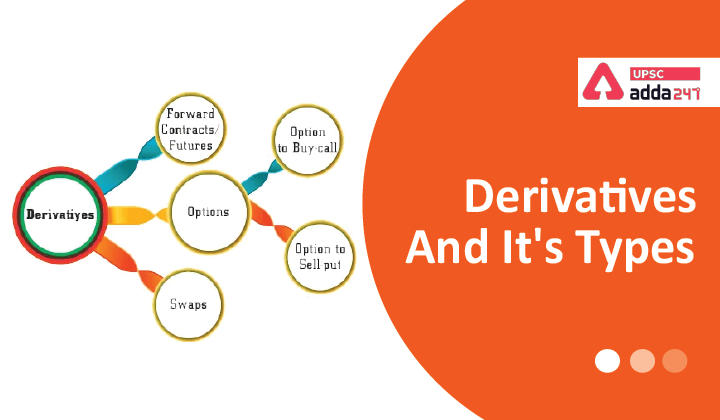

- The most common types of derivatives are forwards, futures, options, and swaps.

- Underlying assets could include commodities, stocks, bonds, interest rates, and currencies.

- People enter into derivative contracts to earn a huge amount of profits by contemplating the underlying asset’s value in the future.

Types of derivatives

Forward

- A forward contract is a customized contract between two parties, where settlement takes place on a specific date in future at a price agreed today. The main features of forward contracts are

- They are bilateral contracts and hence exposed to counter-party risk.

- Each contract is custom designed, and hence is unique in terms of contract size, expiration date and the asset type and quality.

- The contract price is generally not available in public domain.

- The contract has to be settled by delivery of the asset on expiration date.

- In case the party wishes to reverse the contract, it has to compulsorily go to the same counter party, which being in a monopoly situation can command the price it wants.

Futures

- Futures are exchange-traded contracts to sell or buy financial instruments or physical commodities for a future delivery at an agreed price.

- There is an agreement to buy or sell a specified quantity of financial instrument commodity in a designated future month at a price agreed upon by the buyer and seller.

- To make trading possible, BSE specifies certain standardized features of the contract.

Difference between forwards and futures

| Sr.No | Basis | Futures | Forwards |

| 1 | Nature | Traded on organized exchange | Over the Counter |

| 2 | Contract Terms | Standardized | Customised |

| 3 | Liquidity | More liquid | Less liquid |

| 4 | Margin Payments | Requires margin payments | Not required |

| 5 | Settlement | Follows daily settlement | At the end of the period. |

| 6 | Squaring off | Can be reversed with any member of the Exchange. | Contract can be reversed only with the same counter-party with whom it was entered into. |

Options

- Options are derivative contracts that give the buyer a right to buy/sell the underlying asset at the specified price during a certain period of time.

- This contract does not require any compulsion to discharge the contract on a specific date, which means the buyer is not under any obligation to exercise the option.

- Options contracts provide the right but not the commitment to buy or sell an underlying instrument.

Swap

- Swap contracts are the most complex contracts, among the four derivatives.

- Swap contracts mean the agreement is done privately between both parties. The parties who of the swap contracts agree to exchange their cash flow in the future as per a pre-determined formula.

- Under these types of contracts, the underlying security is the interest rate or currency, as these contracts protect both parties from several major risks.

- These contracts are not traded to the Stock Exchange as investment banker plays the role of a middleman between these contracts.

Also Read:

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...