Table of Contents

Sveriges Riksbank Prize 2022: Relevance For UPSC

GS 3: Banking Sector & NBFCs

Sveriges Riksbank Prize 2022: Why in news?

- On October 10, The Royal Swedish Academy of Sciences unveiled the names of the winners of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022.

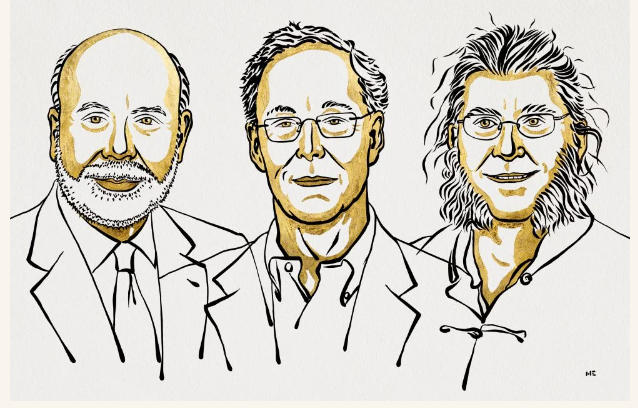

- The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 was awarded to Ben S. Bernanke, Douglas W. Diamond, Philip H. Dybvig “for research on banks and financial crises”.

- The Great Depression of the 1930s paralysed the world’s economies for many years and had vast societal consequences. However, we have managed subsequent financial crises better thanks to research insights from this year’s laureates. They have demonstrated the importance of preventing widespread bank collapses.

Sveriges Riksbank Prize 2022: What is Sveriges Riksbank Prize?

- In conjunction with its tercentenary celebrations in 1968, Sveriges Riksbank (the central bank of Sweden) instituted a new award, “The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” on the basis of an economic commitment by the bank in perpetuity.

- The award is given by the Royal Swedish Academy of Sciences according to the same principles as for the Nobel Prizes that have been awarded since 1901.

Sveriges Riksbank Prize 2022: Why research on banks and financial crises awarded nobel?

- This year the Sveriges Riksbank Prize/Nobel in Economics has been awarded to Bernanke, Diamond and Dybvig for their “research on banks and financial crises” undertaken in the early 1980s which have formed the foundations of what constitutes most modern banking research.

- Their analyses nearly four decades ago, still inform efforts to emphasise the vitality of banks to keep the economy functioning smoothly, the possible mechanisms to make them more robust amid crises periods, and how bank collapses can fuel a larger financial crisis that can rattle economies.

- Moreover, their work went beyond the realm of just theory and has had significant practical import in regulating financial markets and pre-empting or coping with crises.

Nobel Prize in Literature 2022

Sveriges Riksbank Prize 2022: Why have they been picked now?

- The world economy is in the throes of a fresh crisis, just as it was emerging from the COVID-19 pandemic-induced haemorrhaging.

- The International Monetary Fund (IMF) has warned that the ‘worst is yet to come’ and recessionary conditions loom for many countries, as the war in Europe stretches on amid a ‘cost of living’ crisis vitiated by food and energy worries.

- The Nobel jury’s picks may well be construed as a reminder to governments about lessons that would come in handy again as the current tumult unfolds with fears about impending shocks to the banking system.

- These economists’ findings have been proven ‘extremely valuable for policymakers, as is evident in the actions taken by central banks and financial regulators in confronting two recent major crises — the Great Recession [triggered by the global financial crisis between 2007-09 when shadow banks like Lehman Brothers collapsed] and the economic downturn that was generated by the COVID-19 pandemic,’ it underlined.

Sveriges Riksbank Prize 2022: Significance of research on banks and financial crises for India?

- Indian households as well as policy makers are all too familiar with bank failures in the recent past, starting from the trouble at the privately run Global Trust Bank to freezes in withdrawals at several co-operative banks.

- Government and regulatory interventions to sustain faith in the banking system have included higher deposit insurance cover, facilitating takeovers of weaker lenders and steps to rein in bad loans.

- The key learnings from the Nobel Laureates’ work seem to have been embraced by Indian authorities.

- But as the government pursues privatisation of banks while aiming to consolidate lenders to create larger entities to finance bigger investments and higher growth, utmost regulatory and legislative vigil is warranted to pre-empt any mishaps in the financial sector.

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Question Paper 2024, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

TSPSC Group 1 Answer key 2024 Out, Downl...

UPSC Prelims 2024 Question Paper, Downlo...

UPSC Prelims 2024 Question Paper, Downlo...