Table of Contents

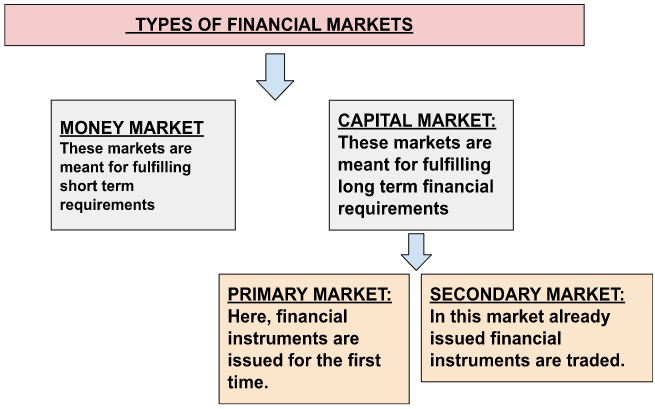

Finance is the lifeblood of any business. Businesses normally require cash for meeting their short-term and long-term requirements. Short-term requirements are met by the money market. On the other hand, long-term financial requirements are met by capital markets. These capital markets are divided into two categories that are: the primary market and the secondary market. Details of the topic are given below:

Types of Financial Markets

Money Market

Money markets hold a high volume of liquidity and arrangement for meeting short-term (less than a year) requirements of borrowers who require funds for a year or less than that. These are comparatively cheaper and have less risk involved.

Capital Market

The Markets in which participants with savings or investments provide funds for more than a year to the ones who require it. These can be further classified into the primary and secondary markets.

-

Primary market

The market where long-term securities such as shares, bonds, debentures etc are issued for the first time is called the primary market. Hence, this market is also known as New Issue Market. This includes instruments like

- IPOs: IPOs stand for Initial Public Offerings made by a company which is earlier a private entity wants to get itself publicly traded by offering shares to the public for the first time. These funds are raised to improve the entity’s infrastructure and repay any debt taken. The right issue is another instrument where companies issue shares to already existing shareholders.

- Private placements: these share offerings are meant for securities that can only be issued to some of the selected reputed and high net-worth individuals or institutions only. The main reason for public placement is lesser regulatory norms and cost-effectiveness as compared to IPOs.

- Right Issue and Bonus Issues: Right issues are those fresh shares that companies offer to their existing shareholders at discounted prices from market prices. On the other hand, bonus shares are those additional shares which are also provided to existing shareholders but the company doesn’t charge anything from the shareholders. These shares are distributed out of companies’ reserves.

2. Secondary market

It is a market where issuing authority of securities doesn’t take part. Here, shares are traded between the investors. This market is regulated by SEBI (Security Exchange Board of India). The prices where securities are traded are determined by demand and supply forces. Equities, preference shares, debentures and bonds are some instruments that are traded here. These can be classified as:

- Fixed Income Instruments: These include those instruments that generate fixed and regular rates of income in the form of interest and dividends. Examples: debentures, bonds and preference shares.

- Variable Income Instruments: These include equity shares of companies that generate income at a variable rate. Here, the return is correlated with the risk undertaken. The risk factor involved here is more than the fixed-income instruments.

- Hybrid Instruments: These instruments have features of both variable and fixed-income securities. Convertible preference shares are an example of this category of instruments.

Primary Market vs Secondary Market

Major differences between the primary and secondary markets are as follows:

| Basis of difference | Primary market | Secondary market |

|---|---|---|

| Meaning | The primary market is the market where instruments of finance are issued for the first time to public or private parties. | Secondary market deals in instruments that are traded between two investors without the involvement of the issuing company |

| Parties involved | Here, sellers are the issuing companies and buyers are the individual or institutional buyers | Here, securities are bought and sold by both investors. |

| Another name | This is known as a new issue market | This is called the after-issue market. |

| Intermediaries | Underwriters and merchant bankers | Brokers |

| Purchase type | Purchase in this market is of direct nature | Purchase in this market is of indirect nature |

| Number of times | Here, the securities are traded only once | Here, the securities are traded more than once |

| Price | Companies sell their instruments at a fixed price | Prices are fixed by demand and supply forces |

| Rules and regulations | The issuer has to comply with a lot of formalities while issuing instruments. | The investors and sellers here follow rules formulated by stock exchanges and SEBI. |

| Type of instruments | IPOs Private Placements Right issues and Bonus issues |

Shares, bonds, options, futures, debentures and derivatives etc. |

Hence, primary and secondary markets are the markets through which firms can fulfil their long-term financial requirements. Primary markets can help companies directly raise funds from investors via initial public offerings, private placements and right issues etc. On the other hand, the Secondary market helps investors to trade in securities.

Download Primary and Secondary Financial Markets Study Notes PDF

To download the PDF of Primary and Secondary Financial Markets Study Notes, candidates should click on the link provided below. It is highly recommended for candidates to download and save this PDF for convenient reference during their preparation and revision.

Phases of Teaching - Stages of Teaching ...

Phases of Teaching - Stages of Teaching ...

स्वर व व्यंजन - �...

स्वर व व्यंजन - �...

UP TGT Sanskrit Syllabus and Exam Patter...

UP TGT Sanskrit Syllabus and Exam Patter...