The CUET UG 2025 exam is now underway. Students are currently looking for the CUET Accountancy Question Paper 2025 to know the types of questions, difficulty level, and other details. The CUET accountancy exam opens doors to some of the best undergraduate courses like B.Com (Hons). To crack the CUET UG 2025 accounts exam paper with a good rank, students need to practice CUET Accountancy important questions in the final days before the exam. That is why we are providing students with the CUET Accountancy Question Paper 2025 with the important questions and answers on this page.

CUET Accountancy Question Paper 2025

The CUET UG Accountancy Exam is held in a computer-based mode and lasts for 60 minutes. In this duration, students need to answer a total of 60 questions, which are multiple-choice based. To score well in the CUET Accounts exam, you should carefully analyze the CUET Accountancy question paper for 2025 as well as the last few years. Our in-house experts have prepared the CUET Accountancy Memory-based question paper based on reviews of test takers. These papers are super beneficial for the students whose exams are scheduled in upcoming shifts. Students should carefully cover and review the CUET Accountancy exam syllabus to increase the chance of getting good scores.

CUET Accounts Question Paper 2025 PDF Download

Download the CUET Accountancy Question Paper 2025 with solutions free PDF from the table below.

| Shifts | CUET Accounts Question Paper PDF link |

| CUET Accounts Question Paper 2025 (May 13 Shift 1) | Download PDF |

| CUET Accounts Question Paper 2025 (May 13 Shift 2) | Download PDF |

| CUET Accounts Question Paper 2025 (May 14 Shift 2) | Download PDF |

CUET Accountancy Important Questions with Answers

The nation’s top rated CUET UG faculty of Adda247 presents you with the top 100+ important questions for the accountancy subject. Along with the questions, you can also check detailed solutions for these questions in the article below. These questions have been compiled after a deep research of the exam materials available from the past years.

Our expert content team also looked at the pattern that the NTA is following to set the question paper. Based on all these assessments, the team came up with the most expected 100 questions that is certain to be asked in the CUET UG accountancy exam. Candidates practicing these questions will surely improve his/her rank by a huge margin.

CUET Accountancy question paper Pattern 2025

The NTA recently altered the CUET Accounts exam pattern for the 2025 exam. The CUET accountancy question paper will no longer feature internal options. Students will have to attempt all the questions. While the exam pattern has been modified, the authority has not made any changes to the CUET UG accountancy exam 2025 marking scheme.

| CUET Accountancy Exam Pattern 2025 | |

|

Parameters |

Details |

|

Mode of the examination |

Computer Based Test (Online) |

|

Type of questions |

Multiple Choice Questions (MCQs) |

|

Total number of Questions |

50 questions |

|

Negative marking |

Yes |

|

Marking Scheme |

+5 for each correct answer -1 for each incorrect answer |

|

Medium of CUET exam |

13 languages – English, Hindi, Assamese, Bengali, Gujarati, Kannada, Malayalam, Marathi, Odia, Punjabi, Tamil, Telugu, and Urdu |

CUET Accounts Important 100 Questions with Answers

Q1. Rearrange the following items of “Equity and Liabilities” head of Balance Sheet in an order as prescribed in Companies Act 2013, Schedule III.

(A) Current Liabilities

(B) Shareholders’ funds

(C) Share application money pending allotment

(D) Non-Current Liabilities

Choose the correct answer from the options given below:

(a) (B), (C), (D), (A)

(b) (C), (B), (A), (D)

(c) (A), (B), (C), (D)

(d) (D), (C), (A), (B)

Q2. Match List – I with List – II.

| List – I | List – II |

| (A) MS Access | (I) Horizontal row of the table |

| (B) DBMS | (II) Vertical column of the table |

| (C) Field | (III) Data Base management software |

| (D) Record | (IV) Data Base management system |

Choose the correct answer from the options given below:

(a) (A)-(II), (B)-(IV), (C)-(III), (D)-(I)

(b) (A)-(IV), (B)-(III), (C)-(II), (D)-(I)

(c) (A)-(III), (B)-(IV), (C)-(II), (D)-(I)

(d) (A)-(IV), (B)-(III), (C)-(I), (D)-(II)

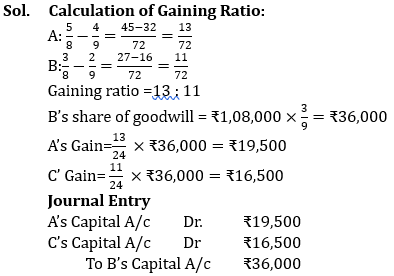

Q3. A, B and C are partners sharing profits and losses in the ratio of 4 : 3 : 2. B retires and the goodwill is valued at ₹1,08,000. A and C decided to share future profits and losses in the ratio of 5 : 3.

Record necessary journal entry.

(a) A’s capital A/c Dr ₹18,000

C’s capital A/c Dr ₹18,000

To B’s capital A/c ₹36,000

(b) A’s capital A/c Dr. ₹67,500

B’s capital A/c Dr. ₹40,500

To C’s capital A/c ₹1,08,000

(c) B’s capital A/c Dr. ₹36,000

To A’s capital A/c ₹19,500

To C’s capital A/c ₹16,500

(d) A’s capital A/c Dr. ₹19,500

C’s capital A/c Dr. ₹16,500

To B’s capital A/c ₹36,000

To C’s capital A/c ₹16,500

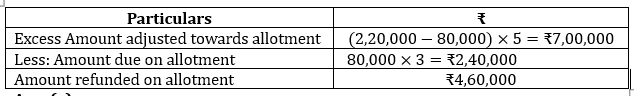

Q4. Avtar Ltd. invited application for 80,000 shares of ₹10 each payable ₹5/-. on Application, ₹3/- on allotment and ₹2/- on call. Public had applied for 2,50,000 shares out of which application for 30,000 shares were rejected and remaining were allotted on pro-rata basis. Excess application money was adjusted against allotment only. Determine the amount to be refunded at the time of allotment of shares.

(a) ₹1,50,000

(b) ₹6,10,000

(c) ₹4,60,000

(d) ₹4,50,000

Q5. Which of the following is/are fact(s) about dissolution of the partnership firm?

(A) The business of the firm is closed.

(B) Assets are sold and liabilities are paid off.

(C) A firm can be dissolved by the court’s order.

(D) The books of accounts are closed.

(E) Economic relationship between the partners continues though in a changed form.

Choose the correct answer from the options given below:

(a) (A), (B), (C) and (D) only

(b) (A), (B), (C) and (E) only

(c) (A), (B), (D) and (E) only

(d) (A), (B), (D) and (C) only

Q6. Securities Premium Reserve can be used for the following purposes:

(A) To issue fully paid bonus shares

(B) To write-off preliminary expenses of the company

(C) To pay premium on the redemption of preference shares and debentures of the company

(D) To distribute as a dividend to share holders

(E) To write-off company losses

Choose the correct answer from the options given below:

(a) (A), (B) and (E) only

(b) (A), (B) and (D) only

(c) (A), (B) and (C) only

(d) (C), (D) and (E) only

CUET Previous Year Question Paper

Q7. Identify the tool of financial statement analysis that represent relationship between two accounting figures.

(a) Comparative statement

(b) Common size statement

(c) Ratio Analysis

(d) Cash flow statement

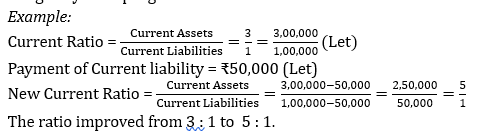

Q8. The current ratio of a firm is 3 : 1. Identify how the payment of current liability will affect it.

(a) Improve current ratio

(b) Reduce current ratio

(c) No change in current ratio

(d) Will affect the solvency ratio

Q9. In the absence of partnership deed:

(A) Partners are allowed interest on capital @6% p.a.

(B) Partners are allowed interest on loan advanced by them @ 6% p.a.

(C) Partners are allowed salary, if they are working partners.

(D) Profits are shared according to capital ratio.

(E) Profits are shared in equal ratio.

Choose the correct answer from the options given below:

(a) (A) and (C) only

(b) (B) and (C) only

(c) (B) and (E) only

(d) (C) and (D) only

Q10. From the following statements, select the ones which relate to Income and Expenditure A/c:

(A) Provides opening and closing cash balances

(B) Prepared on accrual basis of accounting

(C) Records expenditures of revenue nature only.

(D) Records expenditures of revenue as well as capital nature

(E) Records non cash transactions such as depreciation

Choose the correct answer from the options given below:

(a) (A), (D) and (E) only

(b) (B), (C), (D) and (E) only

(c) (B), (C) and (E) only

(d) (C), (D) and (E) only

Q11. Which of the following is/are fact(s) related to cash flows from Operating Activities and Investing Activities?

(A) Receipt from interest and dividends will lead to cash inflow under Operating Activities

(B) Receipt from royalties, fees etc. are cash inflows under Operating Activities

(C) Payment of employee benefit expenses are cash outflow under Operating Activities

(D) Payment for purchase of plant leads to cash outflow under Investing Activities

(E) Payment of taxes are considered as cash outflow under Financing Activities

Choose the correct answer from the options given below:

(a) (A), (B) and (C) only

(b) (B), (C) and (D) only

(c) (C), (D) and (E) only

(d) (A), (B) and (E) only

Q12. With the help of following information of a company, calculate Cash Flow from Financing Activities

April 1, 2016 March 31, 2017

(₹) (₹)

Long term loans 2,00,000 2,50,000

During the year the company repaid a loan of ₹1,00,000.

(a) Outflow ₹50,000

(b) Inflow ₹1,50,000

(c) Outflow ₹1,50,000

(d) Inflow ₹50,000

Q13. Match List – I with List – II.

| List – I | List – II | ||

| (A) | In accordance with a contract between the partners | (I)

|

Compulsory dissolution |

| (B) | When business becomes illegal | (II)

|

Dissolution by court |

| (C) | Death of partner | (III)

|

Dissolution by agreement |

| (D) | Partner became insane | (IV)

|

Happening of certain contingencies |

Choose the correct answer from the options given below:

(a) (A)-(III), (B)-(I), (C)-(IV), (D)-(II)

(b) (A)-(I), (B)-(III), (C)-(IV), (D)-(II)

(c) (A)-(III), (B)-(I), (C)-(II), (D)-(IV)

(d) (A)-(I), (B)-(III), (C)-(II), (D)-(IV)

Q14. Identify that account from which loss on issue of debentures can be written off when securities Premium Reserve fall short.

(a) Debenture Redemption Reserve

(b) Statement of Profit and Loss

(c) Premium on redemption of Debentures A/c

(d) Reserves and Surplus

Q15. Steps in the preparation of Income and Expenditure account are:

(A) Take revenue receipts to the credit side and revenue expenses to the debit side of Income and Expenditure A/c

(B) Persue Receipt and Payment Account thoroughly

(C) Exclude the capital receipts and capital payments

(D) Close the account to find surplus or deficit

Choose the correct answer from the options give below:

(a) (D), (C), (B), (A)

(b) (B), (C), (A), (D)

(c) (C), (B), (A), (D)

(d) (A), (B), (C), (D)

Q16. At the time of admission of a partner, reduction in the value of an asset will be debited to:

(a) Cash A/c

(b) Partner’s Capital A/c

(c) Realisation A/c

(d) Revaluation A/c

Q17. If a creditor accepts an asset whose value is more than the amount due to him.

- He will pay excess amount

- He will not pay anything

- The excess amount will be credited to Realisation Account

- The excess amount is debited to Realisation account

- The excess amount is debited to Bank account

Choose the correct answer from the options given below

(a) A, C and E only

(b) A, B and C only

(c) B, C and D only

(d) C, D and E only

Q18. As per Companies Act-2013, Disclosure related to share capital is compulsory for a period of 5 years immediately preceding the date of Balance sheet:

- Number and class of shares bought back

- Shares reserved under contracts/ commitments

- Forfeited shares

- Number and class of shares allotted for consideration other than cash and bonus shares

- Calls unpaid (Aggregate)

(a) A, B and C only

(b) B, C and D only

(c) A, B and D only

(d) C, D and E only

Q19. The correct sequence of statement of profit or loss

- Other Income

- Total Expenses

- Revenue from Operations

- Profit before extraordinary items & tax

- Total Revenue

Choose the correct answer from the options given below:

(a) C, D, A, B, E

(b) C, D, E, A, B

(c) C, A, E, B, D

(d) A, B, C, D, E

Q20. A and B are partners sharing profits and losses in the ratio 3 : 2. They admitted Z for share. Z got this share as 1/16 from A and 1/16 from B. Calculate sacrificing ratio of A and B.

(a) 3 : 2

(b) 1 : 1

(c) 43 : 27

(d) 2 : 1

Solutions

S1. Ans. (a)

Sol. The correct order for rearranging the items of “Equity and Liabilities” on the Balance Sheet as prescribed in the Companies Act 2013, Schedule III is as follows:

(B) Shareholders’ funds: Shareholders’ funds typically include equity share capital, preference share capital, reserves, and surplus.

(C) Share application money pending allotment: Share application money pending allotment refers to the funds received from shareholders who have applied for shares but have not yet been allocated shares.

(D) Non-Current Liabilities: Non-Current Liabilities are long-term obligations of the company, such as long-term loans, debentures, and other long-term borrowings which are settled after one year.

(A) Current Liabilities: Current Liabilities are short-term obligations that the company needs to pay within a year, including trade payables, short-term loans, and accrued expenses.

S2. Ans. (c)

Sol. (A) MS Access – (III) Data Base management

software: MS Access is a type of database management software used for creating and managing databases.

(B) DBMS – (IV) Data Base management system: DBMS stands for Database Management System, which is a software system for managing databases.

(C) Field – (II) Vertical column of the table: A field is an individual data element within a database, often represented as columns in database tables.

(D) Record – (I) Horizontal row of the table: A record is a collection of related data elements, typically represented as rows in a database table.

S3. Ans. (d)

Sol.

S4. Ans. (c)

Sol.

S5. Ans. (a)

Sol. (A) The business of the firm is closed:

Dissolution means the firm’s operations are stopped.

(B) Assets are sold, and liabilities are paid off: Assets are liquidated to settle debts and obligations.

(C) A firm can be dissolved by the court’s order: Courts can order dissolution in disputes or for protection.

(D) The books of account are closed: Financial records are finalized and transactions settled.

S6. Ans. (c)

Sol. Securities Premium Reserve can be used only for the following five purposes:

(a) to issue fully paid bonus shares to the extent not exceeding unissued share capital of the company;

(b) to write-off preliminary expenses of the company;

(c) to write-off the expenses of, or commission paid, or discount allowed on any securities of the company; and

(d) to pay premium on the redemption of preference shares or debentures of the company.

(e) Purchase of its own shares (i.e., buy back of shares).

S7. Ans. (c)

Sol. Ratio analysis involves calculating various financial ratios that express the relationship between different financial statement items. These ratios help in assessing the financial performance, liquidity, profitability, and other aspects of a company by comparing different accounting figures.

S8. Ans. (a)

Sol. If the current ratio is 3:1, any payment of current liability will improve the ratio. This can be evident from the imaginary example given below:

S9. Ans. (c)

Sol. Provisions of Partnership Act Relevant for Accounting The important provisions affecting partnership accounts are as follows:

(a) Profit Sharing Ratio: If the partnership deed is silent about the profit-sharing ratio, the profits and losses of the firm are to be shared equally by partners, irrespective of their capital contribution in the firm.

(b) Interest on Capital: No partner is entitled to claim any interest on the amount of capital contributed by him in the firm as a matter of right. However, interest can be allowed when it is expressly agreed to by the partners. Thus, no interest on capital is payable if the partnership deed is silent on the issue.

(c) Interest on Drawings: No interest is to be charged on the drawings made by the partners, if there is no mention in the Deed.

(d) Interest on Loan: If any partner has advanced loan to the firm for the purpose of business, he/she shall be entitled to get an interest on the loan amount at the rate of 6 per cent per annum.

(e) Remuneration for Firm’s Work: No partner is entitled to get salary or other remuneration for taking part in the conduct of the business of the firm unless there is a provision for the same in the Partnership Deed.

S10. Ans. (c)

Sol. The statements that relate to the Income and Expenditure Account (A/c) are:

(B) Prepared on accrual basis of accounting: Income and Expenditure Accounts are typically prepared on the accrual basis of accounting, where income is recognized when earned, and expenses are recognized when incurred, regardless of when cash is received or paid.

(C) Records incomes of revenue nature only: Income and Expenditure Accounts primarily record incomes of revenue nature. These are the regular operational incomes of an organization, such as membership fees, subscription fees, donations, etc.

(E) Records non-cash transactions such as depreciation: Income and Expenditure Account may include non-cash transactions like depreciation. It doesn’t involve actual cash expenditure.

S11. Ans. (b)

Sol. The facts related to cash flows from Operating Activities and Investing Activities are:

(B) Receipt from royalties, fees, etc., are cash inflows under Operating Activities: Cash received from royalties, fees, or similar sources related to the core operations of a business is considered a cash inflow from operating activities.

(C) Payment of employee benefit expenses is a cash outflow under Operating Activities: Payments made for employee benefit expenses, such as salaries and wages, are considered cash outflows from operating activities.

(D) Payment for the purchase of plant leads to cash outflow under Investing Activities: Payments made for the acquisition of assets like plants and equipment are categorized as cash outflows from investing activities.

S12. Ans. (d)

Sol.

Cash Flows from Investing Activities

| Particulars | ₹ |

| Loan Acquired | 1,50,000 |

| Loan repaid | (1,00,000) |

| Cash generated from Investing activities | 50,000 |

Working Note:

Dr. Long term Loans Account Cr.

| Particulars | ₹ | Particulars | ₹ |

| To Bank | 1,00,000 | By Balance b/d | 2,00,000 |

| To Balance c/d | 2,50,000 | By Bank (Bal. fig – Loan acquired) | 1,50,000 |

| Total | 3,50,000 | Total | 3,50,000 |

S13. Ans. (a)

Sol. (A) In accordance with a contract between the

partners:

This refers to the voluntary dissolution of a partnership based on an agreement among the partners.

(B) When the business becomes illegal: This refers to compulsory dissolution, which occurs when the partnership’s business activities become illegal.

(C) Death of a partner: This is a situation where the partnership may dissolve due to the happening of certain contingencies, such as the death of a partner.

(D) Partner insane: This is another condition where the partnership may dissolve, and it can lead to dissolution by a court’s order.

S14. Ans. (b)

Sol. When the Securities Premium Reserve is not sufficient to cover the loss on the issue of debentures, the remaining amount of the loss is charged to the Statement of Profit and Loss (also known as the Income Statement or P&L Statement).

S15. Ans. (b)

Sol. The correct steps in the preparation of an Income and Expenditure Account are indeed as follows:

(B) Peruse Receipt and Payment Account thoroughly: Review the Receipt and Payment Account to identify all cash transactions, including both revenue and capital items.

(C) Exclude the capital receipts and capital payments: Separate the capital transactions from the revenue transactions to focus on the income and expenses relevant to the accounting period.

(A) Take revenue receipts to the credit side and revenue expenses to the debit side of Income and Expenditure A/c: Record revenue receipts as credits and revenue expenses as debits in the Income and Expenditure Account.

(D) Close the account to find surplus or deficit: After recording all relevant items, calculate the surplus or deficit by balancing the Income and Expenditure Account.

S16. Ans. (d)

Sol. The reduction in the value of an asset at the time of a partner’s admission is debited to Revaluation A/c. This is done to accurately reflect the decreased value of the asset during the revaluation process and to distribute any resulting profits or losses among the partners.

S17. Ans. (a)

Sol.

- He will pay excess amount: The creditor will pay the excess amount because the asset provided is worth more than the debt owed to them.

- The excess amount will be credited to Realisation Account: The excess amount is added to the Realisation Account to record it as an asset realized during the dissolution of a partnership.

- The excess amount is debited to Bank account: Simultaneously, the excess amount is debited to the Bank account because it represents an inflow of cash or a valuable asset into the firm’s bank account.

S18. Ans. (c)

Sol. Disclosures under the Companies Act-2013:

- Number and class of shares bought back: Companies must disclose the details of shares they repurchased during the specified 5-year period.

- Shares reserved under contracts/commitments: This disclosure informs stakeholders about shares set aside for future issuance as per contracts or commitments.

- Number and class of shares allotted for consideration other than cash and bonus shares: Companies need to disclose shares issued in exchange for non-cash consideration and bonus shares issued during the specified 5-year period.

S19. Ans. (c)

Sol. The correct sequence for the statement of profit or loss:

- Revenue from Operations: This is the starting point, as it represents the primary source of income generated by the company.

- Other Income: After accounting for revenue from operations, other income is added. Other income includes non-operational income sources, such as interest, rent, or dividends.

- Total Revenue: This is the sum of revenue from operations and other income, representing the company’s total income for the period.

- Total Expenses: Next, total expenses are subtracted from the total revenue. This includes all the costs and expenditures incurred by the company in the relevant period.

- Profit before Extraordinary Items & Tax: Finally, after subtracting total expenses from total revenue, you arrive at the profit before considering extraordinary items and tax. This represents the company’s operating profit.

S20. Ans. (b)

Sol. Since A and B have sacrificed equal share in favour of Z, the sacrificing ratio will be 1 : 1.

The rest of the questions and answers is provided in the PDF provided below that contains solutions as well.

How To Prepare for CUET Accountancy Exam...

How To Prepare for CUET Accountancy Exam...

How to Calculate CUET Score, Check Marks...

How to Calculate CUET Score, Check Marks...

CUET Cut Off 2025 (OUT) Soon: Minimum Qu...

CUET Cut Off 2025 (OUT) Soon: Minimum Qu...