Table of Contents

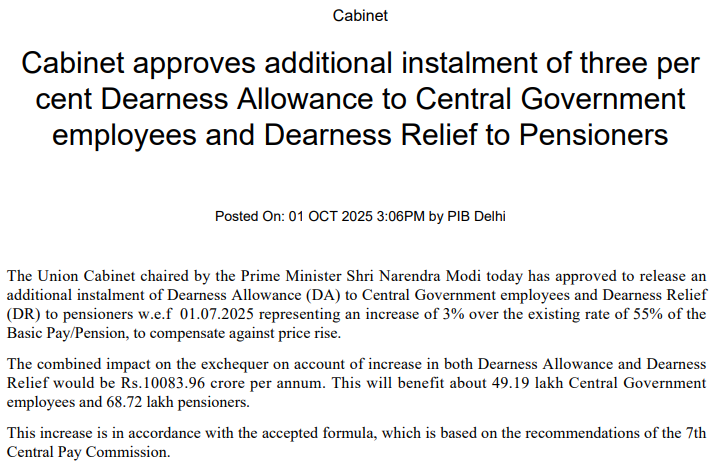

The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved an additional instalment of Dearness Allowance (DA) for Central Government employees and Dearness Relief (DR) for pensioners, effective 01 July 2025. This decision brings a 3% hike over the existing rate of 55% of Basic Pay/Pension, offering much-needed relief against rising inflation.

DA Hike 2025: Latest Update

The 3% increase in DA and DR is a significant relief for Central Government teachers, employees, and pensioners as it safeguards their purchasing power against inflation. Announced just before Diwali, this hike not only improves monthly income but also boosts festive cheer for millions of families across the country.

| Particulars | Details |

|---|---|

| Effective Date | 01 July 2025 |

| Hike Announced | 3% increase (from 55% to 58%) |

| Beneficiaries | 49.19 lakh employees & 68.72 lakh pensioners |

| Annual Financial Impact | ₹10,083.96 crore |

| Formula Used | Based on 7th CPC recommendations |

DA Hike to Benefit Teachers and Employees

The approved DA hike will directly benefit 49.19 lakh Central Government employees, including a large number of teachers across Kendriya Vidyalayas, Jawahar Navodaya Vidyalayas, and other central institutions. Additionally, 68.72 lakh pensioners will also receive increased relief, ensuring their income keeps pace with price rises.

Financial Impact on the Government

The combined impact on the exchequer due to this hike in DA and DR is estimated at ₹10,083.96 crore per annum. Despite the large financial outlay, the move reflects the government’s commitment to supporting its employees and retirees during times of inflation.

DA Hike Ahead of Diwali

Similar to previous years, the announcement of this DA hike has come just ahead of the Diwali festival, ensuring additional festive season relief for employees and pensioners. Last year, in October 2024, the Cabinet had approved a 3% increase in DA, which also benefited millions of Central Government teachers and staff.

What is Dearness Allowance (DA)?

Dearness Allowance is a crucial component of a government employee’s salary. It is calculated as a percentage of the basic pay and aims to offset the impact of inflation on living costs. The DA is revised twice a year—generally around Diwali (October) and Holi (March) based on changes in the All-India Consumer Price Index (AICPI).

How to Calculate Salary for Central Government Teacher

Central Government teachers’ salary is structured according to the 7th Central Pay Commission (CPC). The salary is not just the basic pay but also includes multiple allowances like Dearness Allowance (DA), House Rent Allowance (HRA), and Transport Allowance (TA). Here’s how you can calculate it:

Step 1: Basic Pay (Example Case)

Let’s consider a Trained Graduate Teacher (TGT) with Basic Pay = ₹44,900.

Step 2: Dearness Allowance (DA)

- Effective from 01 July 2025, DA = 58% of Basic Pay.

- DA = 58% of ₹44,900 = ₹26,042 (approx.)

Step 3: House Rent Allowance (HRA)

As per revised rates:

- X Class City = 30% of Basic Pay

- Y Class City = 20% of Basic Pay

- Z Class City = 10% of Basic Pay

For our example:

- X City HRA = 30% of 44,900 = ₹13,470

- Y City HRA = 20% of 44,900 = ₹8,980

- Z City HRA = 10% of 44,900 = ₹4,490

Step 4: Transport Allowance (TA)

- X City: ₹3,600 + DA (58% of 3,600 = ₹2,088) = ₹5,688

- Other Cities: ₹1,800 + DA (58% of 1,800 = ₹1,044) = ₹2,844

Step 5: Gross Salary Calculation

| Component | X City (30% HRA) | Y City (20% HRA) | Z City (10% HRA) |

|---|---|---|---|

| Basic Pay | ₹44,900 | ₹44,900 | ₹44,900 |

| Dearness Allowance (58%) | ₹26,042 | ₹26,042 | ₹26,042 |

| House Rent Allowance (HRA) | ₹13,470 | ₹8,980 | ₹4,490 |

| Transport Allowance (TA) | ₹5,688 | ₹2,844 | ₹2,844 |

| Gross Salary | ₹90,100 | ₹82,766 | ₹78,276 |

Based on 7th Central Pay Commission

The DA and DR revision has been carried out in line with the accepted formula recommended by the 7th Central Pay Commission (CPC). The 7th CPC ensures periodic salary revisions and benefits, keeping government employees’ income in sync with inflationary trends.

KVS NVS Tier 2 Exam City Intimation Slip...

KVS NVS Tier 2 Exam City Intimation Slip...

WBSSC SLST Interview Date 2026 Out, Chec...

WBSSC SLST Interview Date 2026 Out, Chec...

How to Check UP Scholarship Payment Stat...

How to Check UP Scholarship Payment Stat...