Table of Contents

PAN Full Form

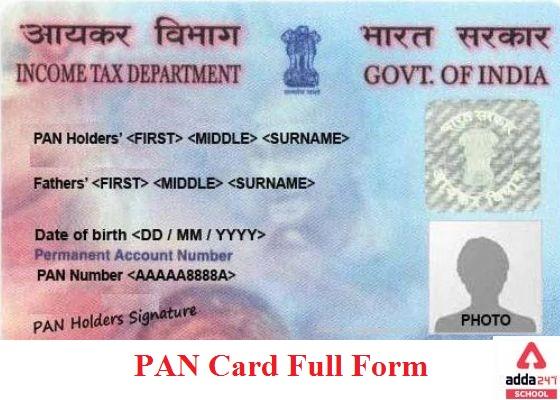

PAN Card Full Form is described here. The full form of PAN is the Permanent Account Number, which is a unique code assigned to Indian taxpayers. PAN is a national identification number that is required of all professions and salaried individuals.

PAN Card Full Form: What is it?

PAN card is a national identification number that is required of all professions and salaried individuals. PAN is supervised by the Central Board of Direct Taxes.

When it comes to creating a bank account, a PAN card is also required. In the event of a change of address, the Pan number stays unaltered. Indian citizens can receive this national document for free, however, each person can only have one card.

Read About Fundamental Rights

PAN ka Full Form

पैन एक राष्ट्रीय पहचान संख्या है जो सभी व्यवसायों और वेतनभोगी व्यक्तियों के लिए आवश्यक है। पैन की निगरानी केंद्रीय प्रत्यक्ष कर बोर्ड करता है।

जब बैंक खाता बनाने की बात आती है, तो एक पैन की भी आवश्यकता होती है। पता बदलने की स्थिति में, पैन नंबर अपरिवर्तित रहता है। भारतीय नागरिक इस राष्ट्रीय दस्तावेज को मुफ्त में प्राप्त कर सकते हैं, हालांकि, प्रत्येक व्यक्ति के पास केवल एक कार्ड हो सकता है।

Read About IG of Police

PAN Card Full form and online Application or Reprinting

The application for a new PAN can be done over the internet. Online applications can be submitted through either the NSDL or UTITSL portals.

For an Indian communication address, the fee is Rs. 93(without Goods and Services tax), and for a foreign communication address, the fee is Rs. 864(without the Goods and Services tax).

The application fee can be paid with a credit/debit card, a demand draught, or through net banking.

After the application and payment have been accepted, the applicant must deliver the supporting documents to NSDL/UTITSL through courier or post. The PAN application will be handled by NSDL/UTITSL only after the documents are received.

Additionally, requests for updates or corrections to PAN data, as well as requests for reprints of PAN cards, can be made via the Internet.

Read About SP of Police

PAN Card Full Form and Required Documents

Proof of address and proof of identification is required documentation for the Permanent Account Number (abbreviated as PAN). An Aadhar card, voter ID, driver’s licence, utility bill, partnership deed, firm registration certificate, and passport are typically required.

PAN Card Full Form: Things to keep in mind

Things to consider when filling out the Pan application

- The application can be completed in English, Hindi, or a regional language.

- You must have a mobile phone number.

- Use all uppercase letters.

- All fields are required.

- During self-attestation, sign your name clearly.

- Rejection is possible if the documentation is incorrect.

PAN Card: Significance

PAN Card holds a very significant role. It is useful and important because:

- Property (immovable) valued at or over Rs.5 lakh for sale or buy.

- Purchase or sale of a vehicle other than a two-wheeler.

- While making payments of more than Rs.25,000 paid to hotels and restaurants, you must quote your PAN.

- When paying direct taxes, you must quote your PAN.

- When paying income tax, taxpayers must enter their PAN.

- If the sum exceeds Rs.25,000, you must provide your PAN.

- Payments of more than Rs.50,000 to bank accounts must be accompanied by your PAN.

Related Post:

| CBSE Full Form | ICSE Full Form |

| CEO Full Form | SOP Full Form |

| AM PM Full Form | ACP Full Form |

P A N Full Form PAN- Permanent Account Number QNA

What is the full form of a PAN Card?

The full form of PAN, the abbreviation, is the Permanent Account Number.

What is a PAN number?

PAN (permanent account number) is a 10-digit alphanumeric number that serves as a confirmation of identity.

In a PAN card, what does the letter P stand for?

The status of the PAN holder is shown by the fourth character of the PAN. An individual is represented by the letter “P.”

How can I get PAN from the internet?

Firstly, go to the NSDL download the e-pan webpage. Fill in the relevant information on the form, such as your date of birth, PAN, and Captcha code. Then, Click’submit’ to obtain a free copy of the e-PAN.

What is the difference between a personal identification number (PAN) and a business identification number?

In a sole proprietorship, an individual PAN is associated with the business and cannot be altered. He will have to register a partnership firm or a company if he requires a new PAN number for the company.

Uttarakhand Board Result 2024 Date Out, ...

Uttarakhand Board Result 2024 Date Out, ...

APOSS Results 2024 Out, AP Open School S...

APOSS Results 2024 Out, AP Open School S...

TN SSLC Result 2024 Date, Check TN 10th ...

TN SSLC Result 2024 Date, Check TN 10th ...