The Bank of India (BOI) has announced the Bank of India Credit Officer Recruitment 2026 for MMGS II, III, and IV posts under the General Banking Officer (GBO) stream. The last date for the online application process is today, that is, 5th January 2026. Interested and eligible candidates are advised to apply as soon as possible to avoid missing out on this golden opportunity to work with the second-largest public sector bank. Read here for more details.

Bank of India Credit Officer Recruitment 2026

The detailed BOI Credit Officer notification (Advertisement No. 2025–26/01) has been published on the official Bank of India website at bankofindia.bank.in. It includes complete details such as eligibility requirements, application steps, selection process, and exam pattern. The last date to apply for this recruitment is January 5, 2026. Candidates can download the BOI Credit Officer Notification 2026 PDF by clicking the link below.

Download Bank of India Credit Officer Notification 2025-26 PDF

BOI Credit Officer Recruitment 2026 Highlights

The selection process for BOI Credit Officer includes an online examination and/or a personal interview, depending on the number of applicants. Successful candidates may be posted anywhere in India, with a monthly salary ranging from Rs 64,820 to Rs 1,02,300, based on the designated post.

| Particulars | Details |

| Organization | Bank of India |

| Post Name |

Credit Officer (GBO Stream)

|

| Total Vacancies | 514 |

| Job Location | Across India |

| Application Mode | Online |

| Last Date to Apply |

Today

|

| Application Dates |

20 December 2025 to 5 January 2026

|

| Selection Process |

Online Exam & Interview

|

| Official Website |

bankofindia.bank.in

|

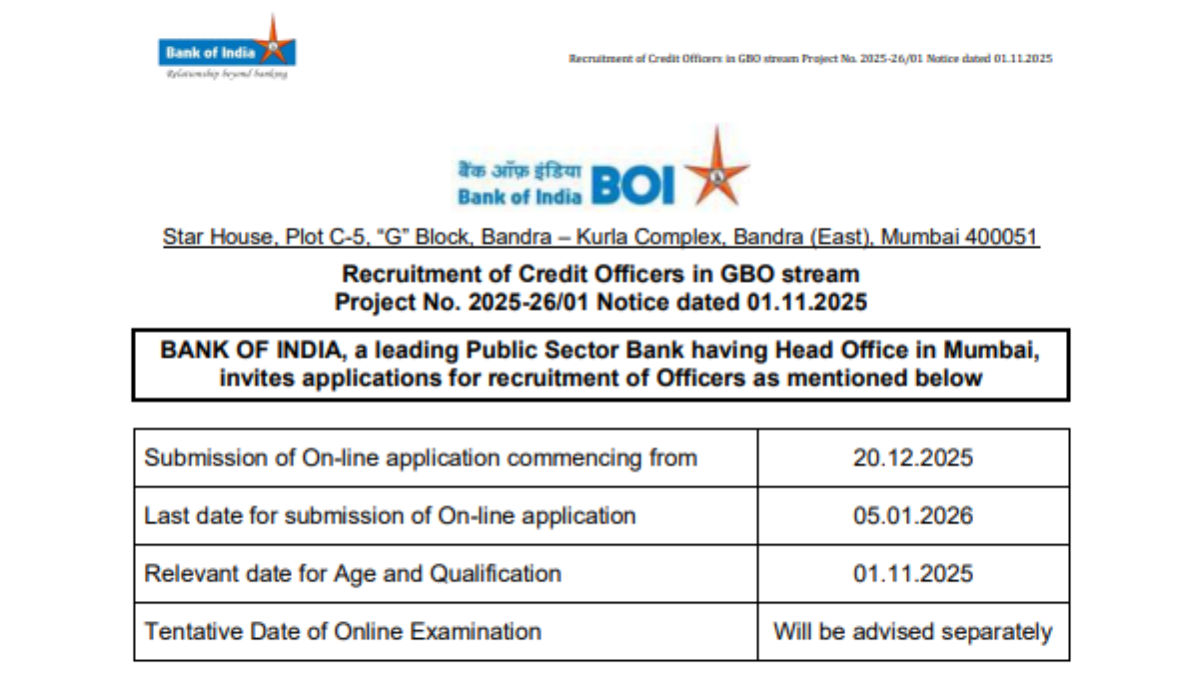

Bank of India Credit Officer 2026 Important Dates

The important dates for the BOI Credit Officer recruitment include the application submission period, which closes Today. The date for the online examination will be announced separately by the bank.

| Event | Date |

| Notification Release Date | 17 December 2025 |

| Online Application Start Date | 20 December 2025 |

| Last Date to Apply Online | 05 January 2026 |

| Cut-off Date for Eligibility | 01 November 2025 |

| Online Exam Date |

To be announced

|

Bank of India Credit Officer 2026 Application Form

Eligible candidates can now apply for the BOI Credit Officer Recruitment 2025–26 through the official Bank of India website. Applicants must complete the registration process, fill in personal and educational details, upload the required documents, and submit the application fee within the specified deadline. The active application link is provided below for easy access, and the last date to apply is today.

BOI Credit Officer Application Form 2025–26 Link – Active

Bank of India Credit Officer 2026 Application Fee

Applicants must pay the specified application fee while submitting their form. The fee differs by category and is provided in the table below:

| Category | Application Fee |

| General & Others |

Rs 850/- (application fee + intimation charges)

|

| SC / ST / PWD |

Rs 175/- (intimation charges only)

|

Note: Applications without successful fee payment will not be accepted.

Bank of India Credit Officer Vacancy 2026

The BOI Credit Officer Vacancy 2026 includes a total of 514 positions across MMGS-II, MMGS-III, and SMGS-IV scales under the General Banking Officer (GBO) stream. The majority of openings are in MMGS-II, followed by MMGS-III and SMGS-IV, providing opportunities for candidates with different levels of experience.

| Scale | SC | ST | OBC | EWS | GEN | Total |

| MMGS-II | 62 | 31 | 112 | 41 | 172 | 418 |

| MMGS-III | 9 | 4 | 16 | 6 | 25 | 60 |

| SMGS-IV | 5 | 2 | 9 | 3 | 17 | 36 |

| Total | 76 | 37 | 137 | 50 | 214 | 514 |

Bank of India Credit Officer 2026 Eligibility Criteria

The Credit Officer Eligibility Criteria specify distinct age limits for each scale, with applicable age relaxations for reserved categories as per government norms. In addition to age, candidates must meet the prescribed educational qualifications, relevant banking/credit experience, and nationality requirements.

Age Limit (as on 01.11.2025)

| Scale | Minimum Age | Maximum Age |

| MMGS-II | 25 Years | 35 Years |

| MMGS-III | 28 Years | 38 Years |

| SMGS-IV | 30 Years | 40 Years |

Age relaxation

Age relaxation is applicable for SC/ST/OBC/PwBD/Ex-Servicemen as per government norms.

| Sr. No. | Category | Age Relaxation |

| 1 | Scheduled Caste / Scheduled Tribe | 5 years |

| 2 | Other Backward Classes (Non-Creamy Layer) | 3 years |

| 3 | Persons with Benchmark Disabilities (as defined under the Rights of Persons with Disabilities Act, 2016) | 10 years |

| 4 | Ex-Servicemen, Commissioned Officers (including ECOs/SSCOs) who have rendered at least 5 years of military service and are released on completion of assignment (including those due to complete assignment within one year from the last date of application), other than dismissal/discharge due to misconduct or inefficiency | 5 years |

| 5 | Persons affected by 1984 riots | 5 years |

Educational Qualification

Candidates must possess the required graduate/postgraduate qualification and relevant work experience as specified in the table below.

| Scale | Educational Qualifications | Other Preferred Qualification/ Certification | Work Experience |

| MMGS-II |

Candidates should have a Bachelor’s degree in any discipline from a recognised university, with 60% marks (or 55% for SC/ST/OBC/PWBD candidates). |

Chartered Accountant/ Chartered Financial Analyst / CMA – ICWA froma recognised institute. OR MBA/ PGDBM in Banking/Finance or Two Years full-time Post Graduation Degree in Banking/ Finance/ any credit-related field from a recognised university/ Institution / Board. |

Minimum 3 years’ post-qualification experience as an officer, out of which 2 years’ experience should be in processing of MSME Credit/Commercial Credit / Project Finance / Mid & Large Credit in Scheduled Public Sector Banks/Scheduled Private Sector Banks/Associate or Subsidiary of Scheduled Commercial Banks/ Public sector or Listed Financial Institution/ Foreign Banks |

| MMGS-III | A Degree (Graduation) in any discipline from a University/ Institute with 60% marks or equivalent grade (55% for SC/ST/ OBC/ PWBD) recognised by the Govt. of India or any equivalent qualification recognised as such by the Central Government |

Chartered Accountant/Chartered Financial Analyst/CMA – ICWA from a recognised institute. OR MBA/ PGDBM in Banking/Finance or Two Years full-time Post Graduation Degree in Banking/Finance/any credit-related field from a recognised university/Institution/Board. |

Minimum 5 years’ post-qualification experience as an officer, out of which 3 years’ experience should be in processing of MSME Credit/ Commercial Credit / Project Finance / Mid & large Credit in Scheduled Public Sector Banks/Scheduled Private Sector Banks/Associate or Subsidiary of Scheduled Commercial Banks/ in a Public sector or Listed Financial Institution/ Foreign Banks |

| SMGS-IV | A Degree (Graduation) in any discipline from a University/ Institute with 60% marks or equivalent grade (55% for SC/ST/ OBC/ PWBD) recognised by the Govt. Of India, or any equivalent qualification recognised as such by the Central Government |

Certificate Course offered by IIBF in International Trade Finance/ Credit Professional/ MSME, AND MBA/ PGDBM from a recognised University /Institution/Board. OR Two Years full time Master’s degree in any field from a recognised University /Institution / Board. OR Chartered Accountant/ Chartered Financial Analyst /CMA – ICWA from a recognised institute |

Minimum 8 years’ post-qualification experience as an officer, out of which 5 years’ experience should be in processing of MSME/ Commercial Credit / Project Finance / Mid & large Credit in Scheduled Public Sector Banks/Scheduled Private Sector Banks/Associate or Subsidiary of Scheduled Commercial Banks/ in a Public sector or Listed Financial Institution/ Foreign Banks |

Nationality

A candidate must be either –

(i) a Citizen of India or

(ii) a subject of Nepal or

(iii) a subject of Bhutan or

(iv) a Tibetan Refugee who came over to India before 1st January 1962 with the intention of permanently settling in India or

(v) a person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African countries of Kenya, Uganda, the United Republic of Tanzania (formerly Tanganyika and Zanzibar), Zambia, Malawi, Zaire, Ethiopia and Vietnam with the intention of permanently settling in India, provided that a candidate belonging to categories (ii), (iii), (iv) & (v) above shall be a person in whose favour a certificate of eligibility has been issued by the Government of India

Bank of India Credit Officer 2026 Selection Process

The selection process for Bank of India Credit Officer Recruitment 2025-26 includes:

- Online Examination

- Personal Interview

If both stages are conducted, the final merit list will be prepared using a 70:30 weightage (Online Exam: Interview).

Bank of India Credit Officer 2026 Exam Pattern

The BOI Credit Officer Exam 2025–26 is conducted as an online objective test with sections covering English Language, Reasoning, Quantitative Aptitude, and Professional Knowledge. The exam includes negative marking for incorrect responses, while the English Language section is qualifying in nature.

- Duration: 120 Minutes

- Negative Marking: 0.25 marks for each wrong answer

- English Language is qualifying in nature.

| Section | No. of Questions | Marks |

| English Language (Qualifying) | 25 | 25 |

| Reasoning | 25 | 25 |

| Quantitative Aptitude | 25 | 25 |

| Professional Knowledge | 75 | 75 |

| Total | 150 | 150 |

Bank of India Credit Officer 2026 Salary

Bank of India provides an attractive pay structure for Credit Officers under the General Banking Officer (GBO) stream. The salary differs based on the management grade, including Middle Management (Grade Scale II & III) and Senior Management (Grade Scale IV).

| Post | Grade / Scale |

Scale of Pay (Rs.)

|

| Credit Officer (GBO stream) | Middle Management Grade Scale-II |

64,820 – 2,340 (1) – 67,160 – 2,680 (10) – 93,960

|

| Middle Management Grade Scale-III |

85,920 – 2,680 (5) – 99,320 – 2,980 (2) – 1,05,280

|

|

| Senior Management Grade Scale-IV |

1,02,300 – 2,980 (4) – 1,14,220 – 3,360 (2) – 1,20,940

|

SSC MTS Admit Card 2026 OUT for Paper 1,...

SSC MTS Admit Card 2026 OUT for Paper 1,...

RSSB Lab Assistant Syllabus 2026, Downlo...

RSSB Lab Assistant Syllabus 2026, Downlo...

RSSB Lab Assistant Recruitment 2026 Out ...

RSSB Lab Assistant Recruitment 2026 Out ...

Adda247 Job portal has complete information about all Sarkari Jobs and Naukri Alerts, its latest recruitment notifications, from all state and national level jobs and their updates.

Adda247 Job portal has complete information about all Sarkari Jobs and Naukri Alerts, its latest recruitment notifications, from all state and national level jobs and their updates.