Career Advancement in Banking and Finance Sector is impossible without clearing the JAIIB and CAIIB Exams. Both JAIIB & CAIIB are the flagship Courses of the Indian Institute of Banking and Finance (IIBF) and it is not just exams but a gateway to career growth, financial increment, and professional recognition. So, if you are new to this exam, then check out complete details about IIBF JAIIB CAIIB here.

What is JAIIB CAIIB Exam 2026?

JAIIB stands for Junior Associate of the Indian Institute of Bankers. Only those who are currently employed in Banking and Financial sector of India are eligible to take this exam.

CAIIB stands for Certified Associate of India Institute of Bankers. It is a more advanced program and only those who qualified JAIIB, can take this exam to further grow their career and salary.

Both JAIIB and CAIIB are conducted twice in a year in May-June and November-December 2026 cycle. JAIIB consists of 4 papers whereas CAIIB consists of 4 Compulsory papers and 1 Elective papers. Both these courses are designed to assess the knowledge base of the candidates and provide an early boost in employees career. So, those seeking to attain maximum heights in their banking career must take this IIBF Exam.

Highlights of IIBF’s Flagship JAIIB and CAIIB Program

Here are some highlights of the JAIIB and CAIIB Exam conducted by the Indian Institute of Banking and Finance (IIBF). As mentioned above, this exam is conducted twice a year to give chance to all applicants.

| JAIIB & CAIIB Exam Highlights | |

| Exam Conducting Body | Indian Institute of Banking and Finance (IIBF) |

| Exam Name | Junior Associate of the Indian Institute of Bankers & Certified Associate of India Institute of Bankers |

| Frequency of the Exam | Twice a Year |

| Registration Process | Online |

| Exam Mode | Online |

| Eligibility | Only Members can Apply |

| No. of Attempts | 5 |

| Official website | www.iibf.org.in |

Eligibility Criteria

Age Limit: To appear for JAIIB and CAIIB Exams, there is no age limit. Candidate of any age can apply, provided that they are currently working in Banking and Finance sector.

Employment: Candidates applying for JAIIB CAIIB, must be working at any Public or Private Banking and Financial institution.

IIBF Membership: Applicant must be a member of IIBF to be eligible.

Qualification: There is qualification criteria for both these exams. It is given in the table below.

| Qualification Required for JAIIB | Qualification Required for CAIIB |

| Candidates must have passed 12th standard in any stream or an equivalent qualification. However, clerical or supervisory bank staff may be allowed to appear without 12th, if recommended by their manager. Subordinate staff can apply only if they have passed 12th or equivalent. | Applicant must have passed JAIIB |

Exam Pattern

The Exam Pattern for JAIIB and CAIIB is totally different except that the format is same. Both have MCQ-type questions. The exam mode is online and there is no negative marking in both JAIIB Exam and CAIIB Exam.

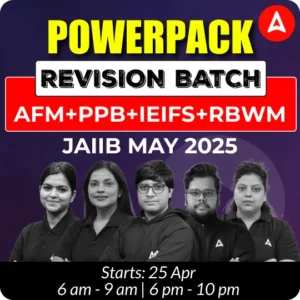

JAIIB Exam consists of 4 papers as given below and each paper carry 100 questions, 100 marks and duration is 2 hours each. Candidate must score 50 out 100 in order to qualify.

| JAIIB Exam Pattern 2026 | ||||

| Papers | Papers | No. of Questions | Total Marks | Duration |

| I | Indian Economy & Financial System | 100 | 100 | 2 hours |

| II | Accounting & Financial Management of Banking | 100 | 100 | 2 hours |

| III | Principles & Practices of Banking | 100 | 100 | 2 hours |

| IV | Retail Banking & Wealth Management | 100 | 100 | 2 hours |

CAIIB Exam consists of 4 compulsory papers and 1 elective paper. Like JAIIB, each paper carries 100 questions and 100 marks and the duration is 2 hours.

| CAIIB Exam Pattern 2026 | ||||

| Paper | Subjects | No. of Questions | Marks | Duration |

| I | Advanced Bank Management(ABM) | 100 | 100 | 2 hour |

| II | Bank Financial Management | 100 | 100 | 2 hour |

| III | Advanced Business and Financial Management | 100 | 100 | 2 hour |

| IV | Banking Regulations and Business Laws | 100 | 100 | 2 hour |

| V | Elective Paper | 100 | 100 | 2 hour |

Registration Dates

The IIBF JAIIB and CAIIB both are conducted twice in a year and the registration dates are different. For the May-June session, registration for both exams is now over, and IIBF is currently conducted exams on the scheduled dates. However, candidates can check the registration dates for the upcoming cycle:

|

JAIIB Registration 2026 Dates

|

|

| Registration Dates |

Application Fees

|

| 01 to 07th August 2025 |

Normal Examination Fees

|

| 08 to 14th August 2025 |

Normal Examination Fees + ₹100/-

|

| 15 to 21st August 2025 |

Normal Examination Fees + ₹200/-

|

| CAIIB Registration 2026 Dates |

|

| Registration Dates | Application Fee Fees |

| 2nd to 8th September 2025 | Normal Examination Fees |

| 9th to 15th September 2025 | Normal Examination Fees + ₹100/- |

| 16th to 22nd September 2025 | Normal Examination Fees + ₹200/ |

Application Fee

While applying first time for the JAIIB and CAIIB Exams, candidates have to pay a fee of Rs. 5000 and Rs. 4000 respectively. But in case you are giving attempts after that, then you have to pay only Rs. 1300.

| Attempts | CAIIB Registration Fee | JAIIB Registration Fee |

|---|---|---|

| First attempt fee | Rs 5,000 | Rs 4000/- |

| Second attempt fee | Rs 1,300 | Rs 1300/- |

| Third attempt fee | Rs 1,300 | Rs 1300/- |

| Fourth attempt fee | Rs 1,300 | Rs 1300/- |

| Fifth attempt fee | Rs 1,300 | Rs 1300/- |

Benefits of Clearing JAIIB and CAIIB

Here, are some of the benefits that the employee can avail of after clearing JAIIB and CAIIB exams.

- Salary Increment: Clearing JAIIB and CAIIB can lead to additional increments, as per bank rules. This directly impacts your overall salary and annual growth.

- Faster Promotions: These certifications are often required for internal promotions. They help you qualify for higher positions more quickly.

- Stronger Banking Knowledge: You gain a deep understanding of banking, finance, law, and risk management. This improves your performance and confidence at work.

- Better Decision-Making Skills: The exams sharpen your ability to analyze and solve real-time banking problems.

You become more efficient in your day-to-day role. - Eligibility for Key Roles: Many specialized or leadership roles in banks require these certifications. Completing them opens the door to such opportunities.

- Support in Internal Exams: JAIIB and CAIIB are often prerequisites for departmental or internal exams. Clearing them improves your chances in competitive internal selections.

Adda247 Job portal has complete information about all Sarkari Jobs and Naukri Alerts, its latest recruitment notifications, from all state and national level jobs and their updates.

Adda247 Job portal has complete information about all Sarkari Jobs and Naukri Alerts, its latest recruitment notifications, from all state and national level jobs and their updates.